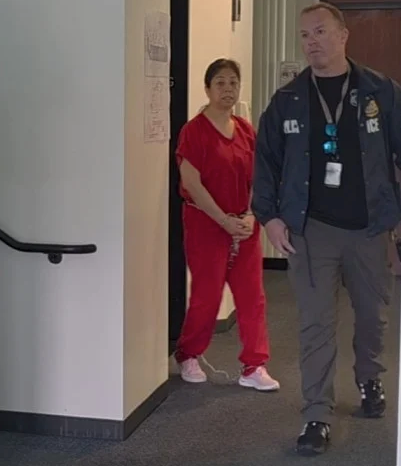

US authorities have moved to prevent the release of former Imperial Pacific International (IPI) chairman Li Jie Cui, escalating a long-running legal saga linked to the collapse of Saipan’s once-ambitious casino development and ongoing enforcement actions in the Northern Mariana Islands.

The case centres on Imperial Pacific International, which had secured exclusive casino rights in Saipan but later became embroiled in financial distress, regulatory breaches, and multiple legal disputes. Li, a key figure during the group’s expansion phase, has faced scrutiny from US authorities over alleged violations connected to the company’s operations and broader compliance failures.

According to court filings and media reports, prosecutors are opposing Li’s release on the grounds that he poses a flight risk and that unresolved legal matters remain active. The move underscores the seriousness with which US agencies are pursuing accountability in the Pacific Islands gaming sector, particularly where large-scale foreign investment intersects with federal labour, immigration, and financial regulations.

The situation also highlights the broader fallout from IPI’s failed Saipan casino project, which was once touted as a transformative investment for the Commonwealth of the Northern Mariana Islands. Instead, the project stalled, leaving behind an unfinished resort, unpaid contractors, and lingering questions about governance, oversight, and suitability of license holders. Local authorities and courts have since worked to unwind the damage, including enforcement actions and asset-related proceedings.

Industry analysts note that the attempt to block Li’s release sends a strong signal to international gaming investors operating under US jurisdiction. Unlike some regional markets where enforcement outcomes can be opaque, US regulators have demonstrated a willingness to pursue individuals, not just corporate entities, when compliance breaches are alleged. This approach may have longer-term implications for how foreign-backed gaming projects are structured and supervised in US-linked territories.

As the legal process continues, the case remains closely watched by regulators, investors, and regional governments alike. Beyond its immediate outcome, it serves as a cautionary tale for emerging gaming jurisdictions in the Pacific: regulatory credibility, labour compliance, and financial transparency are no longer optional—they are foundational to long-term sustainability.

Content Writer: Janice Chew • Wednesday, 26/01/2026 - 13:11:21 - PM

Content Writer: Janice Chew • Wednesday, 26/01/2026 - 13:11:21 - PM