Thailand is exploring the development of a large-scale, Disneyland-style theme park within its Eastern Economic Corridor (EEC), signalling a renewed push to strengthen family-oriented tourism and foreign investment—while deliberately distancing the project from casino gaming.

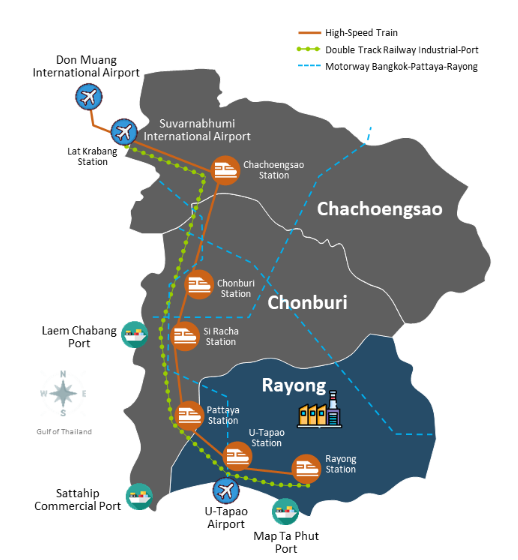

According to policy discussions and industry reporting, the proposed development would be located within the Eastern Economic Corridor, a strategic area covering parts of Chonburi, Rayong, and Chachoengsao provinces. The EEC has been positioned as a cornerstone of Thailand’s long-term economic strategy, focusing on high-value tourism, advanced manufacturing, and international infrastructure projects.

Government officials have reportedly examined models similar to global theme park destinations operated by The Walt Disney Company, though no formal commitment or brand confirmation has been announced. Crucially, authorities have emphasized that any such mega project would not include a casino element, reflecting Thailand’s continued cautious stance on legalized gaming despite ongoing regional debates.

The move comes as Thailand seeks to diversify its tourism offering beyond traditional beach and nightlife segments. A large-scale, globally recognizable theme park could help attract higher-spending family travelers, extend average length of stay, and reduce seasonal volatility. Analysts note that theme parks also generate broader spillover benefits, including hospitality demand, retail growth, and transport infrastructure upgrades.

The decision to exclude casinos is also telling. While several Southeast Asian jurisdictions—including Japan, the Philippines, and Vietnam—have embraced integrated resort models that combine gaming with entertainment, Thailand appears to be drawing a clearer line between mass-market tourism development and casino legalization. Observers suggest this reflects both political sensitivities and a desire to avoid social pushback while still capturing international investment.

From an investment perspective, the EEC location offers strong fundamentals: proximity to Bangkok, existing transport links, and government-backed incentives. However, industry watchers caution that execution risk remains high. Mega theme parks require long development timelines, substantial capital, and sustained visitor flows to achieve returns—particularly in a competitive Asia-Pacific leisure market.

If the project advances, it could reshape Thailand’s tourism landscape and reposition the EEC as a family-friendly leisure hub rather than a gaming-led destination. More broadly, it underscores a regional divergence in development strategies, with Thailand betting on entertainment, branding, and accessibility—while keeping casino gaming firmly off the table, at least for now.

Content Writer: Janice Chew • Wednesday, 26/01/2026 - 14:49:47 - PM

Content Writer: Janice Chew • Wednesday, 26/01/2026 - 14:49:47 - PM