On August 4, 2025, Dae Sik Han, Chairman and CEO of Hann Philippines Inc., revealed the rationale behind moving forward with an IPO for Hann Holdings Inc., the parent company behind the integrated Hann Casino Resort in Clark Freeport Zone. In an interview on One News, Han stated the public listing was necessary “to ensure no delays” in executing his ambitious development roadmap.

Han explained that while retaining full ownership for now might seem attractive, doing so could severely limit future growth.

“If I don’t go for an IPO right now … I can have 100% ownership … but then in two or three years from now, what will be the value of the company?”

Rather than slow down or pace the project conservatively, Han sees listing now as a strategic move to unlock the capital needed to accelerate development and raise shareholder value.

“It’s much better to go to the public market and then be aggressive because I know that this will improve the value of the company in a couple of years.”

Funding Transformative Growth in Clark

Hann Holdings aims to raise approximately PHP11.8 billion (about US $207 million) through its Philippine Stock Exchange debut. The capital will finance expansions at the existing resort and launch the Hann Reserve Phase 1, a high-end golf and gaming estate near New Clark City.

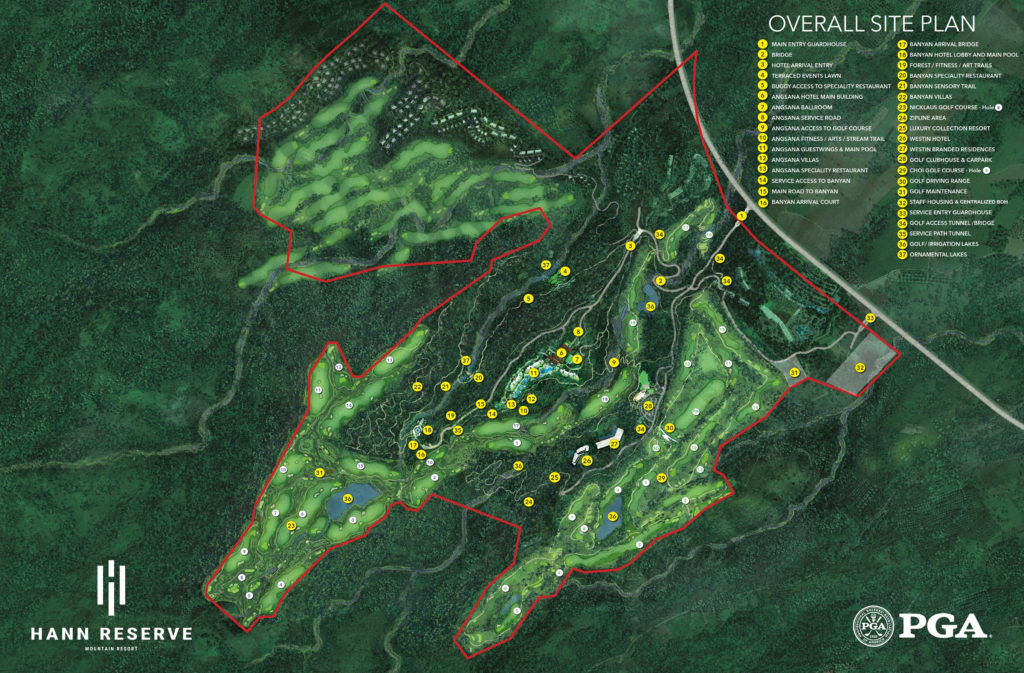

Hann Reserve encompasses nearly 450 hectares, and its first phase will feature three championship golf courses—including PGA-affiliated player development facilities—luxury hotel brands, residences, retail, an international school, and a casino. Han emphasized that while gaming contributes around 85% of his revenue, golf is a key differentiator in a crowded IR market.

“One of the most important things is you have to make yourself different … That’s why I have to spend money … because [golf] is a supporting facility for the gaming.”

Growing Financials and Market Position

As of early 2025, Hann Resorts already commands nearly 48% market share in Clark’s land-based casino sector, with strong performance driven by both domestic and Korean visitors and close proximity to Clark International Airport.

Financially, Hann Holdings posted 2024 revenues of PHP12.57 billion and first-quarter 2025 net income up 35%, although interest expenses rose sharply amid its aggressive expansion—which pushed its debt-to-equity ratio down from 2.2 to 2.0. The IPO proceeds are expected to reduce leverage and support scaling across both physical and digital channels, including the fast-growing Hann Live Online platform.

Listing Timeline and Strategy

Regulatory approval has already been granted by the Philippine SEC, clearing the way for a September stock market debut. The IPO will involve 500 million primary shares priced at PHP23.60 each (around US $0.42), with up to 50 million overallotment shares available. The listing is scheduled for September 23, 2025, following an offer period from September 9 to 15 on the main board of the Philippine Stock Exchange.

Looking Ahead

With golf, luxury hotels, branded residences, and comprehensive gaming facilities, Hann Resorts is carving out a unique identity in Clark as more IR developers eye the region. As Han candidly put it:

“If I’m not ready to compete with them, then all of the things that I have achieved will go down the drain. That’s why I have to push myself to the limit to expand.”

The IPO represents more than a capital raise—it’s a strategic move to maintain momentum, stay ahead of growing competition, and actualize a master plan that Han believes will elevate Clark into a premier leisure and tourism destination in Southeast Asia.

Content Writer: Janice Chew • Monday, 25/08/2025 - 17:09:27 - PM

Content Writer: Janice Chew • Monday, 25/08/2025 - 17:09:27 - PM